A Modern Approach to Wealth Preservation

Greetings, Visitor.

Welcome to the ever-evolving landscape of Bitcoin and its transformative potential as a “Store of Value.”

As we embark on this journey, we will dive deeper into blockchain technology, ETFs, NFTs, DAOs, and other cutting-edge innovations that solidify Bitcoin’s position as a modern asset for wealth preservation.

Join me, Paul Mindra, your host and guide as we explore the research and insights of prominent figures like Michael Saylor and Andreas Antonopoulos to unravel the intricate tapestry of Bitcoin’s future.

As we move further, I want you to keep one thing firmly in your mind:

The beauty of Bitcoin is that there are to be only 21.000.000 (Twenty-One Million) in circulation and each Bitcoin can be divided into 100.000.000 (One-Hundred Million) pieces, each called a “Satoshi.” We must understand this.

“Accept” is a verb meaning to receive something willingly. “Except” is used as a preposition meaning not including, a synonym of but all except one, and is also commonly used as a conjunction.

Learn More Here about an “Errors & Omissions Disclaimer”.

Did you know that Google is the Grandchild of Archie & Veronica? I did not.

Page Navigation

- Introduction – The Rise of Bitcoin

- The Concept of “Store of Value”

- The Genesis of Bitcoin and Blockchain Technology (Benefits for the Elderly?)

- EFTs and Bitcoin

- Exploring Web3, DeFi, NFT, DAOs & Smart Contracts: The Future of Technology

- The Wisdom of Andreas Antonopoulos

- Michael J. Saylor

- Future Predictions and Credibility

- Summary

- Additional Resources

-

- So, what is money? – Andreas Antonopoulos

- Think of money as energy – Michael Saylor & Firas Zahabi

- Bitcoin is energy in Cyber Space – Michael Saylor

- Bitcoin’s submission to Nature – Michael Saylor

- Everyone is wrong about the Bitcoin Halving – Michael Saylor prediction

-

- Blockchain Explained in 7 Minutes

The Rise of Bitcoin

On this page, let’s try to unravel the captivating journey of Bitcoin, a Digital Transformation Phenomenon that is revolutionizing how we perceive money.

Drawing from my personal experiences I can’t help but marvel at the sheer potential and disruptive power of Bitcoin. Like when I stumbled upon a hidden gem in the digital world (Wealthy Affiliate), Bitcoin has emerged as a beacon of financial freedom and empowerment for individuals worldwide since its inception in 2009.

Created by an unknown person or group using the pseudonym Satoshi Nakamoto, Bitcoin was introduced as a peer-to-peer electronic cash system to eliminate the need for intermediaries like banks in financial transactions.

The rise of Bitcoin has been nothing short of meteoric, with its value surging from mere cents to thousands of dollars per coin within a few years. Its limited supply and decentralized nature have captured the imagination of many, sparking a global frenzy, and paving the way for a more inclusive and transparent financial ecosystem.

Below is one of the first documentaries I watched on Bitcoin. It was back in 2018 and features some of the OG’s (Original Gangsters) – slang for “The Earliest Adopters of Bitcoin.”

The Rise and Rise of Bitcoin | DOCUMENTARY | Bitcoins | Blockchain | Crypto News | Digital Cash

Bitcoin is a revolutionary digital currency that enables decentralized payments, challenging traditional banking systems. The video explores Bitcoin’s history, adoption, and the controversies surrounding its anonymity and regulation. Must Watch – the Introduction with a human touch.

Highlights:

- Bitcoin is a technology that changes how money works, allowing for global and decentralized transactions;

- It was created by an anonymous person named Satoshi Nakamoto in 2008 – 2009;

- Bitcoin operates on a peer-to-peer system with no central authority, making it resistant to manipulation;

- It gained momentum in 2010 when it was used to purchase two pizzas, marking the first real-world transaction; and,

- Bitcoin faced challenges, including thefts and skepticism, but continued to gain mainstream acceptance.

The Bitcoin Whitepaper Explained – Here

With only 21 million coins to ever exist, Bitcoin is designed to be deflationary, unlike traditional fiat currencies that can be printed endlessly. This scarcity has fueled a digital gold rush among investors seeking to hedge against inflation and economic uncertainties.

Moreover, the decentralized nature of Bitcoin, enabled by the blockchain technology it is built upon, has attracted proponents of financial sovereignty and privacy. By allowing users to send and receive funds without a central authority, Bitcoin offers a level of autonomy and security that traditional financial systems lack.

Despite skepticism and regulatory challenges, Bitcoin continues to gain mainstream acceptance as more businesses, institutions, and individuals adopt it as a legitimate form of payment and investment. The rise of Bitcoin signifies a paradigm shift in how we perceive and interact with money.

In a world where traditional financial systems are being challenged, Bitcoin offers hope for those seeking autonomy and security in their transactions. It’s no wonder this digital asset continues to captivate the hearts and minds of a diverse audience, from tech-savvy millennials to seasoned investors looking to diversify their portfolios and have access to a genuine “Store of Value.”

The Concept of “Store Of Value”

The key characteristic of a store of value is its ability to maintain its worth over time, despite external factors such as inflation, economic downturns, or political instability. This is why people often turn to stores of value to protect their wealth from depreciation or loss.

Traditionally, stores of value have included assets like gold, real estate, and fine art, which have been used to preserve wealth and hedge against inflation. However, in recent years, Bitcoin has emerged as a potential contender to become the future of storing value.

Bitcoin’s value is not controlled by any central authority, making it a potentially more stable store of value in times of economic uncertainty.

The Benefits of Bitcoin as a Store of Value:

- Limited Supply: Unlike fiat currencies that can be printed endlessly, Bitcoin has a finite supply cap of 21 million coins. This scarcity factor ensures that Bitcoin retains its value over time, much like precious metals such as gold;

- Decentralization: Bitcoin operates on a decentralized network known as the blockchain, eliminating the need for intermediaries like banks or governments. This peer-to-peer system gives individuals full control over their wealth, free from external influences; and,

- Transparency: Every Bitcoin transaction is recorded on the blockchain, a public ledger accessible to anyone. This transparency ensures system integrity and builds trust among users, making Bitcoin reliable.

As more institutional investors and corporations recognize Bitcoin’s potential, its adoption and acceptance continue to grow. With increasing mainstream interest and acceptance, Bitcoin may become the future of storing value for individuals and institutions looking to diversify their portfolios and protect their wealth in the digital age.

While Bitcoin’s volatility remains a concern for some investors, its unique properties and growing acceptance suggest that it could play a significant role in reshaping the landscape of stores of value in the years to come.

Ultimately, a store of value serves as a financial anchor in uncertain times, providing stability and security for individuals looking to protect their wealth for the long term. Whether it’s gold, real estate, or digital assets, the concept of a store of value remains a fundamental aspect of financial planning and wealth preservation in today’s ever-changing world.

The Genesis of Bitcoin and Blockchain Technology (Elderly Benefits?)

Bitcoin and blockchain technology may seem like complex concepts, but let’s break it down in a way that’s easy to understand.

Imagine a digital currency called Bitcoin that exists only online, just like money in your bank account. This Bitcoin is stored in a digital wallet on your computer or phone, and you can use it to buy things or send it to other people.

Now, let’s talk about Bitcoin and blockchain technology. The key innovation behind Bitcoin is the blockchain, which acts like a digital ledger and records all transactions made with the currency. Instead of one central authority keeping track of who owns what, the blockchain is maintained by a network of computers worldwide. Each transaction is verified by these computers and added to a “block” of data, which is then linked to the previous block, creating a chain of information that is secure and transparent.

Blockchain explained in 7 minutes – Watch, Listen & Learn Here.

For the elderly like me, it’s important to understand that Bitcoin and blockchain technology offer a new way of handling money and transactions in the digital age. With traditional banking systems, there are often fees, delays, and the risk of fraud. But with Bitcoin, transactions can be faster, cheaper, and more secure because they are verified by multiple computers (Nodes) on the blockchain network.

One of the benefits of Bitcoin and blockchain technology is the potential for financial inclusion. People who may not have access to traditional banking services, like those in developing countries, can participate in the global economy with just an Internet connection. This can empower individuals to have more control over their finances and access new opportunities for growth and investment.

In conclusion, Bitcoin and blockchain technology represent a new frontier in finance and technology. While it may seem daunting, understanding how these innovations work can help navigate the changing landscape of digital currencies and decentralized systems. Embracing these technologies can open new possibilities for financial independence and security in the digital age.

EFTs, ETFs, and Bitcoin

EFTs, or Electronic Funds Transfers, refer to the electronic movement of money from one account to another. This can include direct deposits, online bill payments, and wire transfers. EFTs provide a convenient and secure way to manage financial transactions without physical checks or cash. It’s like using a digital version of traditional banking services.

Be careful not to confuse EFTs with ETFs.

An ETF or Exchange-Traded Fund is an investment fund that tracks the performance of a specific asset or group of assets, such as stocks, bonds, commodities, or currencies. It is traded on stock exchanges similar to individual stocks.

In the context of Bitcoin, some ETFs specifically track the price and performance of Bitcoin. These Bitcoin ETFs allow investors to gain exposure to Bitcoin without owning it directly. Instead, they own shares in the ETF representing ownership in a pool of Bitcoins held by the fund.

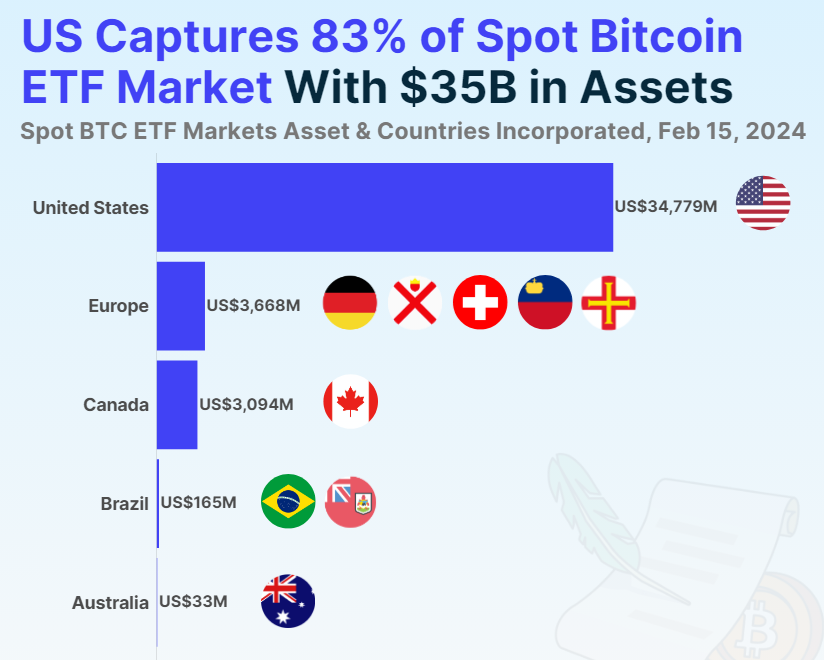

Which Countries Have Spot Bitcoin ETFs?

The value and performance of a Bitcoin ETF correlate with fluctuations in the price and value of Bitcoin itself. As the price of Bitcoin changes, it affects the value and performance metrics (such as net asset value or NAV) of the ETF. So if there is an increase in Bitcoin’s price, investing in a Bitcoin-based ETF can potentially provide similar gains. While Bitcoin is not widely accepted for everyday transactions, it has gained popularity as a speculative investment. It’s important to note that Bitcoin’s value can be volatile, and it’s essential to approach it with some reserve.

An important thing to note is that not all countries have approved or introduced regulated cryptocurrency-based ETFs yet. However, several jurisdictions are currently exploring or considering approving such financial products.

With the recent approval of Bitcoin ETFs by regulatory bodies, such as the SEC, institutional and retail investors can now access Bitcoin as a legitimate investment option, further solidifying its status as a Store of Value.

ETFs and Bitcoin represent advancements in financial technology that can offer convenience and new opportunities. However, it’s important to approach these technologies with a clear understanding of their benefits and risks and to seek guidance when navigating the evolving landscape of digital finance.

Exploring Web3, DeFi, NFTs, DAOs & Smart Contracts: The Future of Technology

As we peer into the horizon of digital innovation, Web3, DeFi, NFTs, and DAOs are emerging as key concepts shaping the future.

Web3 refers to the next generation of the internet, which aims to decentralize data and power away from big tech companies, giving users more control over their online activities.

DeFi, short for decentralized finance, is a system that allows people to access financial services without traditional intermediaries like banks, offering opportunities for increased financial inclusion and autonomy.

NFTs, or non-fungible tokens, are unique digital assets representing ownership or proof of authenticity of a specific item, such as digital art, collectibles, or virtual real estate.

DAOs, or decentralized autonomous organizations, are entities governed by smart contracts and operated by community members, enabling collective decision-making and resource management without a centralized authority.

Smart Contracts are digital agreements stored on a computer network. It works automatically without needing a middleman to oversee it. Imagine it as a virtual vending machine that can execute tasks based on predefined rules.

For instance, if you want to sell a house using a smart contract, the contract can automatically transfer ownership to the buyer once they pay the required amount. This process is secure because the contract is stored on a blockchain, which is a highly transparent digital ledger. Smart contracts can be used to buy goods, exchange money, or even vote in elections. They are becoming popular because they can help make transactions faster, cheaper, and more secure. It’s like having a digital assistant making everything happen as agreed upon.

For the elderly population, understanding these technologies may seem daunting at first, but their potential impact is significant. Web3, for instance, could lead to enhanced privacy and security online, offering a more user-friendly and transparent internet experience. DeFi has the potential to provide accessible financial services, potentially reducing reliance on traditional banking systems.

NFTs can be seen as a way to digitize and authenticate valuable items, preserving and showcasing cultural heritage and personal memories. DAOs, while complex in their structure, have the potential to enable inclusive and participatory governance models, allowing individuals to have a voice in decision-making processes.

In conclusion, the future of technology, encompassing Web3, DeFi, NFTs, DAOs, and Smart Contracts, holds promise for a more inclusive, secure, and participatory digital world. While the concepts may be new, their potential benefits for individuals and communities are worth exploring. Embracing these technological advancements could lead to a more empowered and connected society, offering new opportunities and avenues for engagement.

The Wisdom of Andreas Antonopoulos

Andreas M. Antonopoulos is a British-Greek Bitcoin advocate, tech entrepreneur, and author.

He was born in 1972 in London and moved to Athens, Greece during the Greek Junta (1967 – 1972) where he spent his childhood and at age 17, returned to the U.K.

Andreas obtained standing in Computer Science, Data Communications, Networks, and Distributed Systems from University College London.

In 2012, Antonopoulos became enamored with Bitcoin. He eventually abandoned his job as a freelance consultant and started speaking at conferences about Bitcoin, consulting for startups, and writing articles free of charge.

On 8 October 2014, Antonopoulos spoke in front of the Banking, Trade and Commerce Committee of the Senate of Canada to address the senators’ questions on how to regulate Bitcoin in Canada

He has been featured in numerous documentary films and is a permanent host on the Let’s Talk Bitcoin podcast with more than 400 episodes recorded. He also released his podcast “Unscripted” from his most popular talks. Antonopoulos is working on his sixth book and third technical work, Mastering the Lightning Network.

This talk has been called the Greatest Crypto Explanation of ALL time.

In the video below Andreas explains why Bitcoin and open public blockchains will transform the world of finance and the internet itself. Even though it has been termed “the internet of money,” people are beginning to realize that this is more than just money, and certainly more than what they’re being told. Must Watch & Listen.

Video Breakdown:

- 0:00 Introduction

- 0:49 Bitcoin

- 2:21 What is money?

- 5:08 Money as a content-type

- 6:01 Borderless money

- 7:02 The children born today will not know a world in which banks exist

- 7:55 The bitcoin protocol

- 11:32 More than a thousand other cryptocurrencies have been created

- 12:24 Large corporations and crypto 13:25 Distributed consensus 14:19 The unbanked and centralized systems

- 16:59 Permissionless

Visit Andreas’ YouTube channel Here.

Michael J. Saylor

Michael J. Saylor is an American entrepreneur and business executive known for his leadership in the technology sector. Born on February 4, 1965, in Lincoln, Nebraska, Saylor attended the Massachusetts Institute of Technology (MIT), where he earned a double major in aeronautics and astronautics. In 1989, he co-founded MicroStrategy, a business intelligence software company that quickly became a major player in the industry.

Under Saylor’s guidance, MicroStrategy pioneered data analytics and business intelligence tools, helping companies make informed decisions based on data-driven insights. Saylor’s visionary approach to technology and data analytics has earned him recognition as a thought leader.

In recent years, Saylor has gained attention for his advocacy of Bitcoin and cryptocurrency. In 2020, he made headlines for MicroStrategy’s bold move to convert a significant portion of the company’s cash reserves into Bitcoin, a decision that has since proven to be highly profitable. Saylor has become a vocal proponent of Bitcoin as a store of value and a hedge against inflation.

Michael Saylor’s career has been marked by innovation, entrepreneurship, and a willingness to embrace new technologies. His contributions to business intelligence and cryptocurrency have solidified his reputation as a forward-thinking leader in the tech industry.

Michael Saylor Interview: Why You NEED At Least 0.1 Bitcoin in 2024

The video script (below) discusses the importance of owning at least 0.1 Bitcoin by 2024, highlighting factors driving Bitcoin’s value and potential growth. It also touches on the impact of historical events on power dynamics, the significance of technological advancements, and the importance of studying history for investment success.

Successful investors like Warren Buffett focus on key investments rather than diversifying for higher returns. Michael Saylor believes Bitcoin’s risk-reward proposition in 2024 is better than ever, as institutional adoption and regulatory clarity drive its growth, with the potential to subsume all store-of-value property worth $400 trillion. This, too is a “Must Watch & Listen.”

Some Highlights:

- Michael Saylor is a well-known figure in the Bitcoin space and a pioneer in institutional adoption of Bitcoin.

- Through Saylor’s wisdom and advice, the interviewer now enjoys financial security and the ability to travel the world.

- Saylor emphasizes the importance of studying history, particularly the rise and fall of civilizations, to understand the recurring patterns and mistakes made in monetary systems.

- Bitcoin is seen as a solution to the broken monetary system that has plagued civilizations throughout history.

- The launch of Bitcoin ETFs has been highly successful, surpassing expectations and attracting significant demand.

Recent News:

- Bitcoin is the Apex Property of the Human Race – Mar 12, 2024 – Yahoo Finance.

- Bitcoin Is Digital Property – Mar 11, 2024 – CNBC.

- Bitcoin Represents The Digital Transformation of The Capital – Feb 15, 2024 – Fox Business.

- The emergence of Bitcoin as a Treasury Reserve Asset – Dec 19, 2023 – Bloomberg

Future Predictions and Credibility

As we peer into the crystal ball of Bitcoin’s future, many experts predict a continued rise in its value and adoption.

With institutional investors, corporations, and even governments showing interest in Bitcoin, its credibility is the ultimate Store of Value in the digital age.

Through their research, contributions, and advocacy, Saylor and Antonopoulos have pivotal roles in shaping the narrative around Bitcoin’s future as wealth preservation.

We stand at the cusp of a new era in financial innovation. Bitcoin emerges as a beacon of hope for those seeking a secure and decentralized Store of Value. By embracing these technologies and staying informed about the latest developments in the digital asset space, we can pave the way for a future where Bitcoin reigns supreme as the ultimate preservation of wealth in the digital age. So, arm yourselves with knowledge, seize opportunities, and embark on a journey towards financial empowerment and prosperity. The future is bright, and Bitcoin is leading the way.

Summary

In 2016 I bought about USD 2,050.00 of Bitcoin when it became fashionable in my circle to invest in what turned out to be a Ponzi Scheme.

Well, I no longer participate in such schemes and that circle, well that circle continues to do what that circle does and it does not include me.

I had made some returns in that program, but most of it was gone. Feeling disgusted and mostly embarrassed, I put the matter behind me and forgot about it. Dejected, I focussed on more important things – my future. I got immersed in learning about online Affiliate Marketing and Website Design.

By 2021, Bitcoin had become somewhat mainstream and tens of millions were starting to adopt this phenomenon. I went to revisit Bitcoin but had misplaced the flash drive I had all my Blockchain.com info on. Ouch. I also could not find the 12-word recovery phrase I had written down and put in a safe place in case I needed it. That is where my journey began with Bitcoin. To find that flash drive and that elusive piece of paper.

Long story short, In 2022 I found “my stuff,” got access to my account, and discovered that I had 1/3 of a Bitcoin still there. Merry Christmas, I thought to myself. I wish I had purchased more back then, but that was just the greedy side of me speaking.

Remember what I asked of you at the beginning of this page?

“As we move further, I want you to keep one thing firmly in your mind:

The beauty of Bitcoin is that there are to be only 21.000.000 (Twenty-One Million) in circulation and each Bitcoin can be divided into 100.000.000 (One-Hundred Million) pieces, each called a ‘Satoshi.'”

So now, am I the owner of 1/3 of a Bitcoin, or 33,000,000 Satoshi?

We have learned that Bitcoin offers a new and innovative approach to wealth preservation, catering to those seeking a modern Store of Value in an increasingly digital world. Whether we’re just entering retirement or enjoying our golden years, exploring the potential of Bitcoin as a financial asset can open up new avenues for securing our wealth (however limited it may be) and embracing the future of finance.

We stand at the cusp of a new era in financial innovation. With blockchain technology, ETFs, NFTs, DAOs, Smart Contracts, and the visionary insights of thought leaders like Michael Saylor and Andreas Antonopoulos, Bitcoin emerges as a beacon of hope for those seeking a secure and decentralized Store of Value.

So, by embracing these technologies and staying informed about the latest developments in the digital asset space, we can pave the way for a future where Bitcoin reigns supreme.

Arm yourselves with knowledge, seize opportunities, and embark on a journey towards financial empowerment and prosperity. The future is bright, and Bitcoin is leading the way.

As a digital property, Bitcoin has the potential for significant value appreciation, making it a valuable investment. The current period is likened to a ‘Bitcoin Gold Rush’ era with various factors driving momentum.

Misunderstanding and fear of Bitcoin due to lack of education and mainstream criticism hinder its adoption and growth potential, leading to a slow demand increase. Identify and focus on transformational technologies like AI and Bitcoin for success. Avoid diluting focus by pursuing multiple ventures, leading to mediocrity and failure.

Leave a comment – Let’s start a conversation.

Your host and Guide, Paul Mindra.

Additional Resources:

So, what is money?– Andreas Antonopoulos

How to Think of Money as Energy – Michael Saylor & Firas Zahabi

Bitcoin Is Energy In Cyber Space | Michael Saylor

Bitcoin’s Submission to Nature – Explained by Michael Saylor

“EVERYONE Is Wrong About The Bitcoin Halving” – Michael Saylor Prediction

Blockchain Explained in 7 Minutes